Divorce proceedings often require complex financial negotiations, and family lawyers shoulder the responsibility of ensuring transparency and fairness.

The (Family Law) Rules (2021) in Australia require both parties to a divorce to disclose their bank statements from the past 12 months, which is used by the court to assess the financial situation of each party accurately.

A family lawyer’s role in this process is to:

- capture the pool of assets available to be divided up

- understand each parties’ contributions to the marriage

- pose specific queries to the other party if they have suspicion the other party may be embezzling assets

Negotiation Leverage: Identifying unresponsible purchases and embezzlement of funds helps lawyers advocate for fair and equitable distribution of assets, protecting their clients' financial interests.

Child Custody Considerations: Financial behavior on bank statements can impact child custody & financial support decisions, as they provide insights into a party's financial stability and responsibility.

Supporting Legal Strategy: The insights derived from bank statement analysis inform legal strategies, allowing lawyers to build stronger cases and increase the likelihood of achieving favorable court outcomes.

Family lawyers face the arduous and error-prone task of manually collating and analyzing bank statements.

This time-consuming process is currently solved by manually requesting documents from clients and manually searching through statements for suspicious transactions

The demand for a more accurate, efficient and cost-effective solution can be met by digital transformation.

Hugely inefficient status quo

Family lawyers spend about 5 hours a week manually requesting documents, scrutinising statements, and inquiring about transactions.

2

RIsk of overlooking details

The level of scrutiny is variable, raising the risk of overlooking crucial details in certain cases.

3

Family lawyers express a clear desire for a solution that can automate the disclosure process.

Solution

Develop an integrated platform tailored for family lawyers that allows clients to seamlessly upload their bank statements. The platform utilises AI-technology & algorithmic analysis to automatically flag standout transactions, and provides family lawyers with a streamlined interface for efficient inquiry and analysis of these transactions.

Low-Fidelity Prototyping

Simple ER diagram

Matter Creation

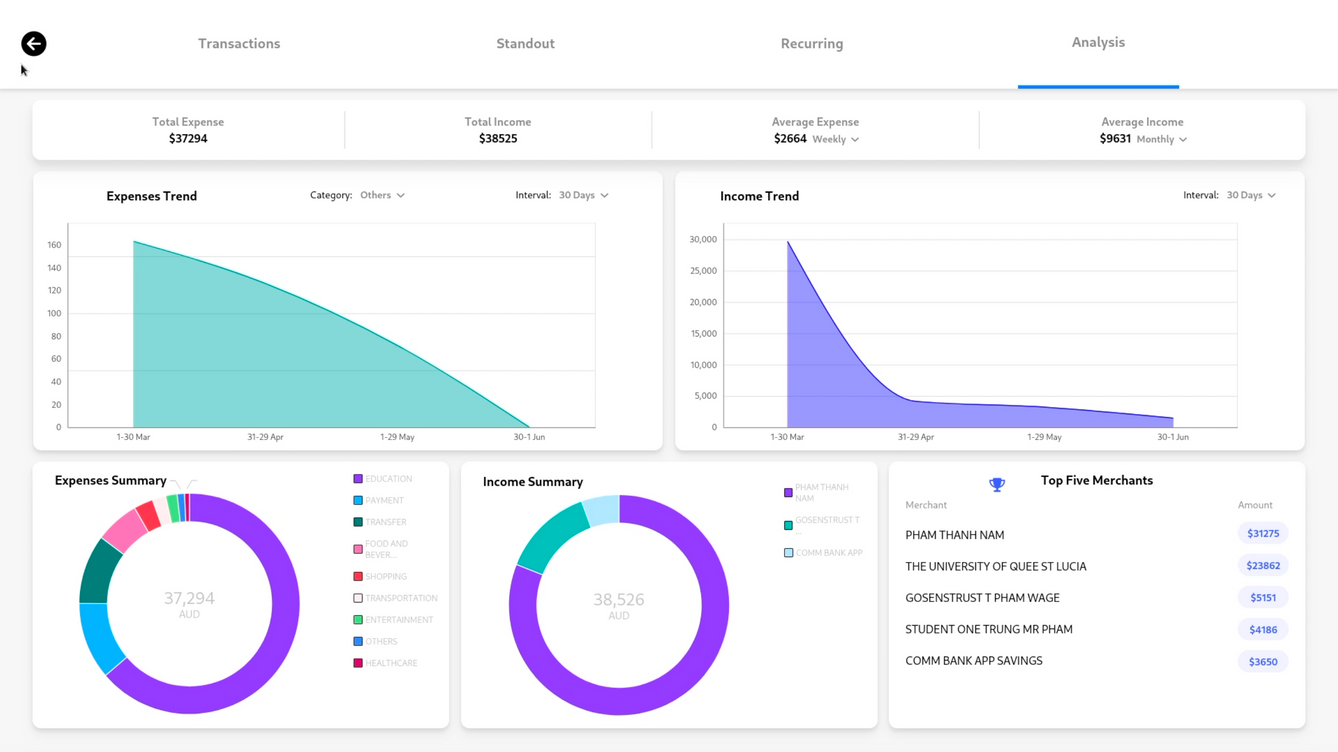

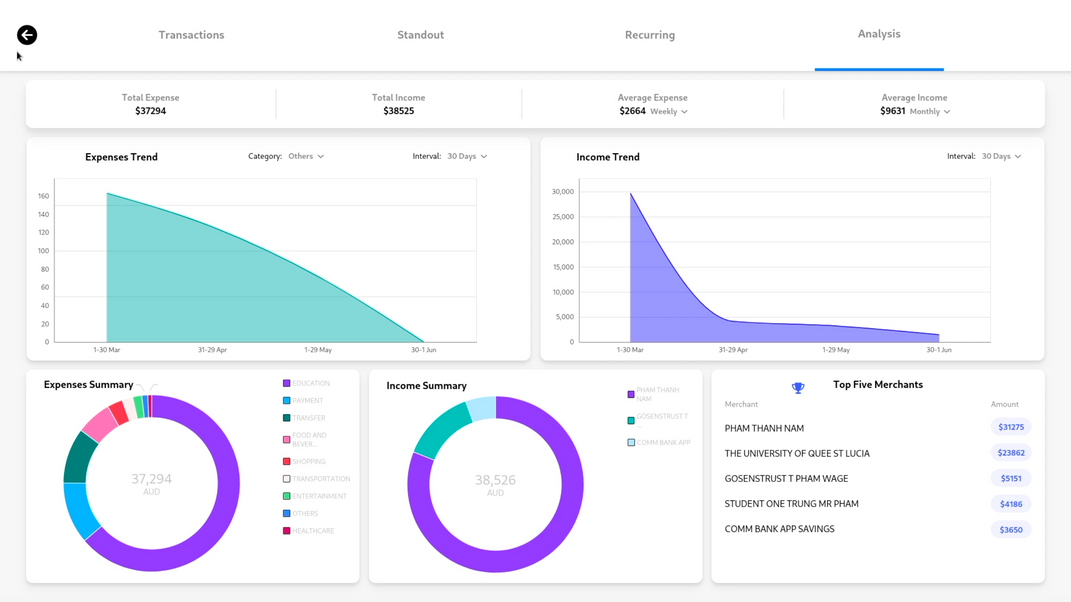

Analysis Module

High Fidelity

Prototyping

MVP

Easily onboard clients with Collaborative Sharing

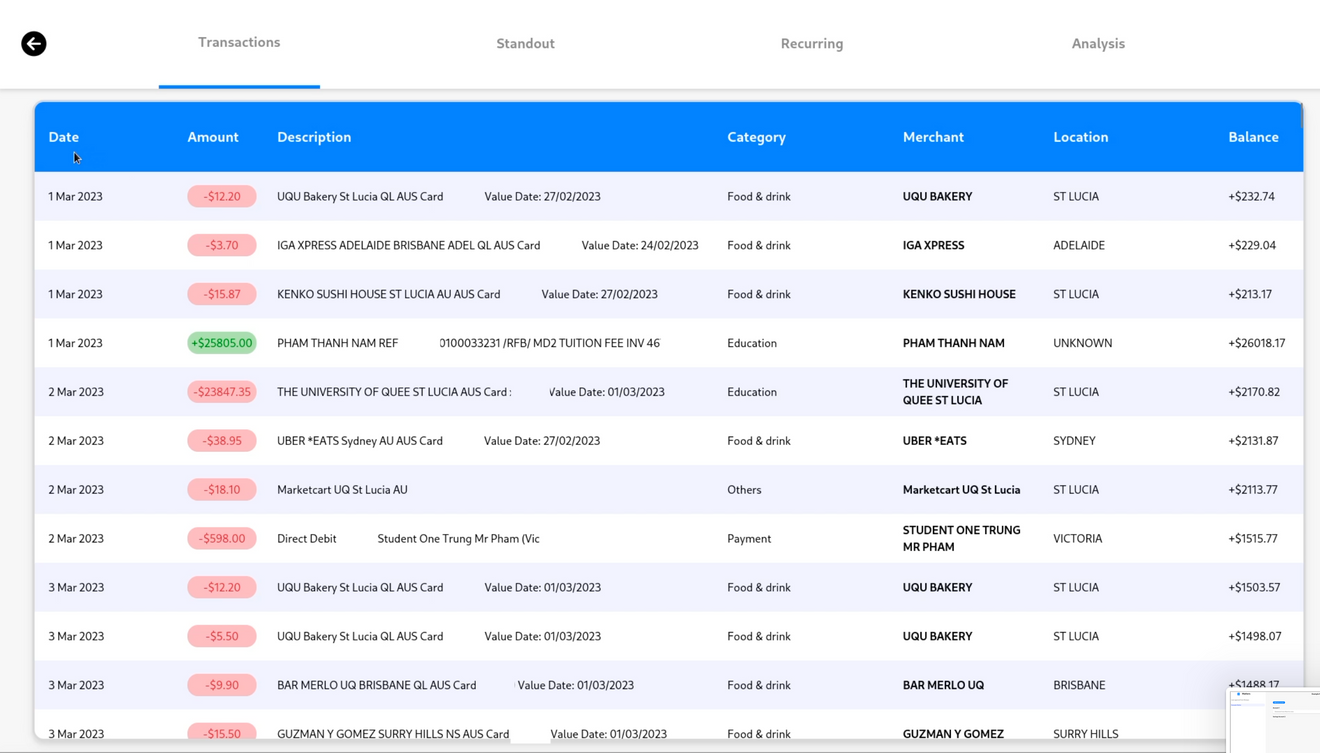

A family lawyer may easily grant a client access to the platform, allowing them to upload bank statements, with AI guidance.

Ai-POWered Transaction Categorisation

Our AI-integration allows our software to extract categorical data from the statement including the merchant, location & category of transaction.

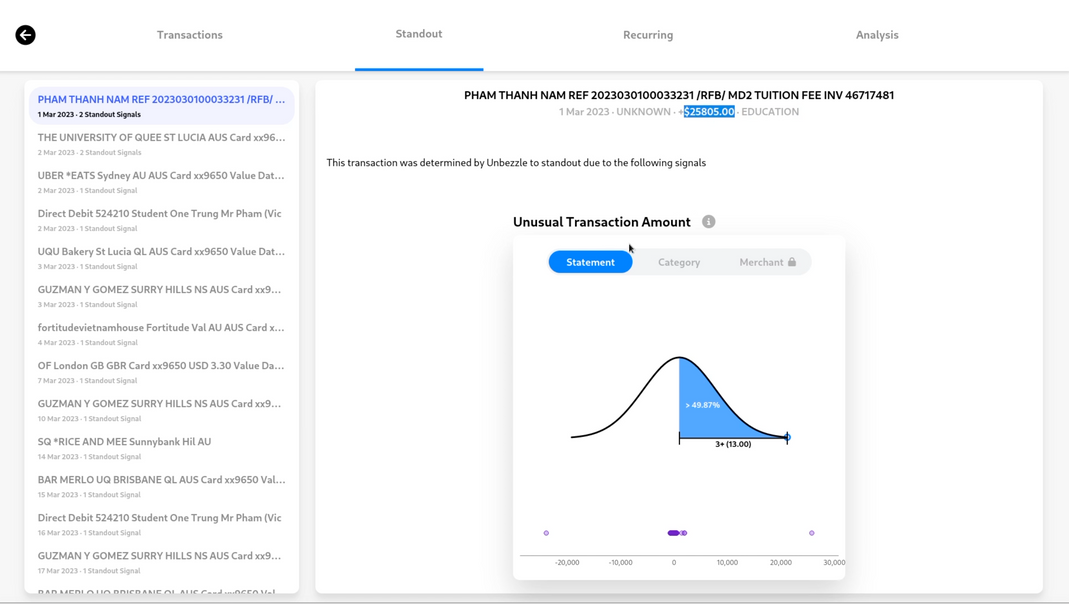

Quantitative flagging algorithm

Using the AI-extrapolated information, our quantitative algorithm is able to search for standout ‘signals’ to flag. This may include a recurring bank transfer to an unknown account, or suspected drug purchases.

1. Client

Interface

(Both sides )

Questioning flagged transactions

4. Solicitor interface

Uploads

statements

Flagged

transactions

2. AI Categorisation

3. Quantitative

Flagging Algorithm

Passes on array

of data-points

Stack Summary

Innovation, Impact & Value to Tech in Law

Our platform paves the way for

Machine Learning: Using historical data and user feedback, the machine learning model is continuously trained and refined to improve accuracy in detecting standout transactions, adapting to new and evolving methods of suspicious financial activity.

Scalability: The program’s ability to handle large volumes of bank statement enables lawyers to spend more time on higher-level tasks or take on more clients, boosting the productivity, accessibility and affordability of legal services

Improved Decision-Making: The program can provide insights and recommendations based on its analysis, helping lawyers make more informed decisions when negotiating or litigating settlements to achieve a more fair and equitable outcome for their client

We've brought together a skilled team to address this challenge and lead the way in developing our solution. Comprising talented law & computer science students, our team possesses a rich reservoir of expertise and networks stemming from our experiences in legal-tech startups and established law, tech and trading firms.

We're running a case study and iterated on our solution based on feedback from family lawyers, forensic accountants, consultants and tech startup founders to custom-build a platform that is intuitive, easy to use yet comprehensive and meets the needs of family lawyers and their clients.